Salesforce’s Financial Services Cloud is designed for the financial sector with retail, corporate and investment banking, wealth management, insurance, and mortgage businesses in mind. It provides customer-centric experiences that are seamless and allow the interactions between the customer accessing the financial service and those employed to deliver the right products, services, assistance, and information at the right time.

When a new Financial Services Cloud instance is created Person Accounts are enabled by default. In a brownfield org, the individual data model may be in use. Individual Accounts are for representing a business entity that will have multiple contacts associated with them. They can also be used to represent individuals with a one-to-one relationship, eg Jane Doe Account and Jane Doe Contact. Salesforce supports the individual model for Orgs with existing individual model implementations only.

Person Accounts are a representation of all aspects of an individual customer (such as birthdate, national ID’s, and direct dealings with them) – a person not a company. Person Accounts are a hybrid of the Account and Contact Objects. When enabled, the Salesforce platform automatically creates the Person Account and Person Contact record, and then binds them together. Using the example above, Jane Doe stops being two records but becomes one Person Account named Jane Doe.

The result is that we can use all the Accounts and Contacts fields and capabilities easily from the “one” record. Essentially a Person Account can use the functionality of either object to solve such use cases as relating to an individual person or an opportunity. The Account object is directly related to an Opportunity out of the box, but a contact is only related through the Opportunity Contact Roles Object. We can therefore directly relate a Person Account to an Opportunity.

If Financial Services Cloud is being applied to an existing Salesforce Org, take the following considerations into account:

- Turn on Person Accounts if not enabled (this is irreversible once in place).

- Set Up Lead Conversion and Referral Management for Person Accounts

- Review

- All Business Processes that touch the Account and Contact object

- All Automations (triggers, flows, workflow rules)

- Lightning Components

- All integrations between third-party systems and Salesforce

- All AppExchange packages installed in the org (particularly for whether they support Person Accounts)

- The Organization-Wide Defaults (OWD) sharing for Account and Contacts are limited to either Controlled by Parent on Contact or Private on both Account and Contact

For further information about Person Accounts go to this Salesforce Help Article.

Relationships: Account/Contacts

Financial Services Cloud is all about the customer-centric relationships. Utilising the Account Contact Relationship Standard Object and two Financial Services Custom Objects (Account-Account Relationship and Contact-Contact Relationship). It is possible to define the relationships between:

- A person and a business/ other account (Account Contact Relationship)

- A business/other account and another business/ other account (Account-Account Relationship)

- Two people (Contact-Contact Relationship)

Underpinning this is the Reciprocal Role Financial Services object that defines social patterns/interactions between people (mentor & mentee, spouses, grandparents & children, siblings, etc)

For example:

Sam is a single parent with legal custody of his two children (Sasha and Alex). He has a Financial Advisor Anya M and Everyday Bank. and a Lawyer Tope A. at Everyone’s Advocates Ltd who assisted Sam with his divorce and child proceedings.

Sam’s relationships with these people would be as follows:

- Contact-Contact Relationship and the Reciprocal Role:

- Sam is parent to Sasha – Sasha is child to Sam

- Sam is parent to Alex – Alex is child to to Sam

- Account Contact Relationship and the Reciprocal Role:

- Sam is client to Anya – Anya is financial advisor to Sam

- Sam is client to Tope – Tope is lawyer to Sam

- Account-Account Relationship and the Reciprocal Role:

- Sam is customer to Everyday Bank – Everyday Bank is Bank to Sam

- Sam is client to Everyone’s Advocates Ltd – Everyone’s Advocates Ltd is legal firm to Sam

Households and Groups

A Household (an Account record type) in Financial Services Cloud represents a group of clients and businesses whose financials are summarised at the group level.

A group represents a collection of individuals and/or institutions that are related through the account contact relationship records. This can be a Household, Professional Group or possibly a Trust. A group gives insight into the financial circles around a customer. Information about a group’s members are rolled up.

A person can be linked to multiple Households, but there can only ever be one primary member.

Sam’s household group would look like this:

- Sam’s Household

- Sam (Primary Member)

- Sasha (Beneficiary)

- Alex (Beneficiary)

Sam’s parents may also be customers in the same org. Therefore Sam’s parents’ household group may be as follows:

- Sam’s Mum (Primary Member – as she was the first customer who the company worked with)

- Sam’s Dad (Spouse)

- Sam (Beneficiary)

Under the Relationship Tab, this will start to look like the following on Sam’s record:

So now we have the Relationships showing, let’s dive into the rollups.

Record Rollups

Client and Group level rollups are supported in Financial Services Cloud. These aggregate information from related objects records for all primary group members.

Client-level rollups are aggregated by default. There is no need to set them up.

Group-level rollups need to be enabled to aggregate related records for all primary group members.

The group-level rollups are key for enabling a view of how financials change in a primary group as members join and leave them.

Records that can be rolled up are:

- Financial Accounts

- Financial Goals

- Assets and Liabilities

- Referrals

- Events

- Tasks

- Opportunities

- Cases

- Claims

- Claim Participants

- Insurance Policies

- Insurance Policy Participants

As a relationship is added to the primary group, it can be edited so that the user can determine what records should rollup to the group level.

To optimize the processing time for Record Rollups, Enable Record Rollup Optimization. Additionally to make the processing of record rollups faster when performing rollups in batches at the household level, use the Record Rollup Configuration custom setting. This allows for the separate configuration of rollup settings for different objects. By doing this, it is possible to limit how many records are processed in a batch.

It is also possible to optimize record rollup triggers through the Custom Metadata Type “Use Standard Triggers”.

These are all inactive out of the box, set them as active to improve performance.

Rollup by lookup (RBL) rules

Rollup by Lookup Rules provides aggregation data at a high level. These rules run when a financial account record of primary group membership is edited. The rules configuration updates all client and group-level summaries that correspond to the record edited.

A record change does not always trigger the Rollups by Lookup Rules. There are three conditions that are evaluated before they run:

- Is the record type Id for the edited record included in the rule?

- Does the running user have “Enable Group Record Rollups” and “Enable Rollup Summary” in the Custom Setting “Wealth Management Config” applied to their User (by profile or username)

- Does the WHERE clause evaluate to true (where there is one)

A list of the Rollup by Lookup Rules is here. These should not be edited, created, or otherwise customised.

These can be deactivated when a large data load is expected.

Rollups Summary

Using these rollups a complete picture of the Financials for a person and their related Household can be gathered. They are incredibly useful for that customer-centric view of customers.

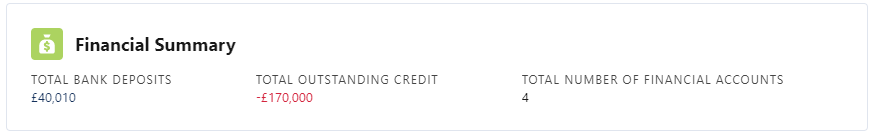

With the Financial Services Cloud Trial, sample data is included that helps illustrate what is possible. This is a summary of Rachel Adams (a sample account)’s financial situation:

And then her Household’s financial situation:

If this was to be applied to the example of Sam, the financial accounts, would rollup in his household for:

- Sam’s financial accounts (current balance £20,000)

- Sam’s Mortgage (current balance £170,000)

- Sasha’s trust account set up for her by her grandparents (current balance £10,005)

- Alex’s trust account set up for his by her grandparents (current balance £10,005)

In summary, Rollups and Relationships form a strong and key part of FSC. Understanding this is the basis of great client service.

To read more in our Financial Service Cloud Series: