This is a short article about Financial Goals in Financial Services Cloud. Their purpose is to enable a user to track their customers’ saving related goals. A user can speak with their customer to capture their wishes and goals for the future and track towards their completion. This could be a holiday or home purchase or saving towards retirement.

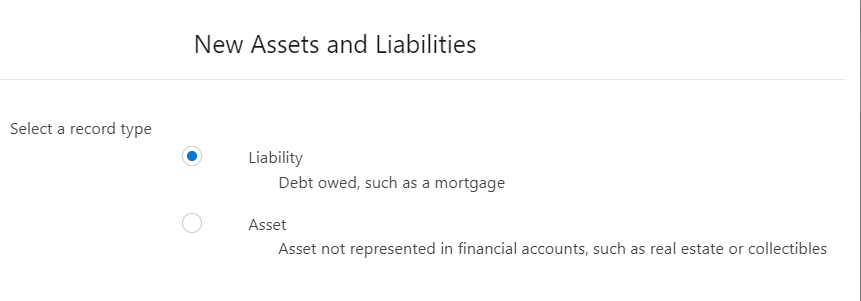

A goal cannot be created for a mortgage or other debt repayment. Mortgages and other debts (along with assets) are entered under Assets and Liabilities.

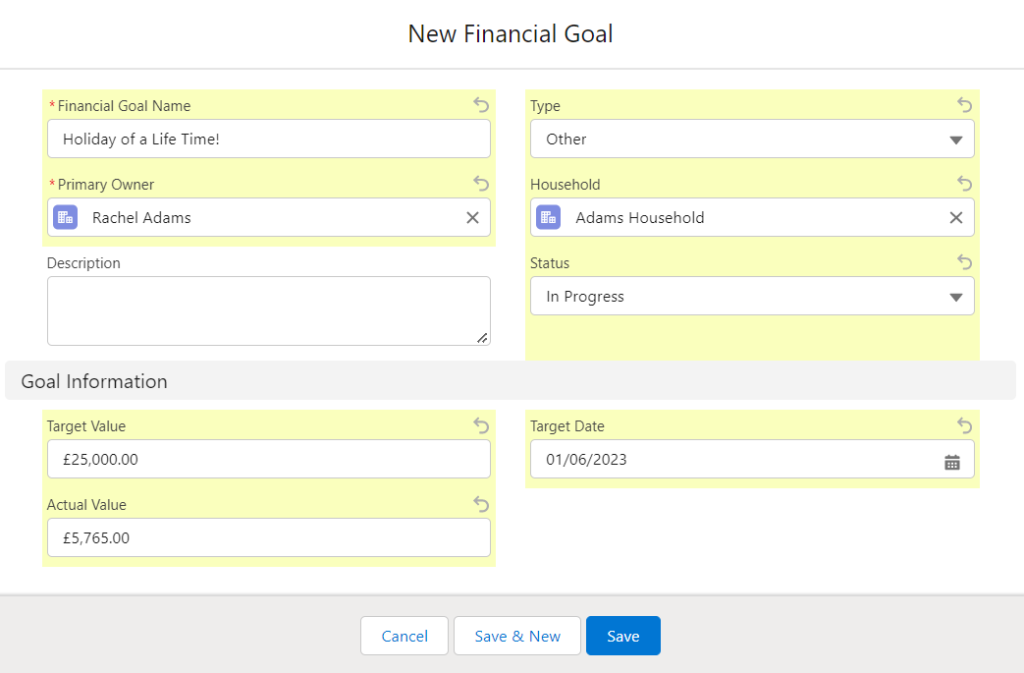

An example below is a holiday related goal.

The customer informed their financial advisor of the cost and their current fund towards it. If needed, the financial advisor can follow up on their progress and suggest financial products that may assist them to reach it by their desired timeframe.

Create a new Financial Goal from the Goals tab on the Household or Person Account level. If it is created from the Household, by default the Primary Member of the Goal appears in the Primary Owner field.

If you try to relate a Financial Goal to a different Household account, when you save, it will revert to the Primary Owner’s Primary Group. This is working as designed. See this knowledge article.

Once saved, it will appear on the page layout on the person’s page under Goals as below:

When a Financial Goal is added it can be summarised at the primary group Household level. An example of this is below:

This gives the user context to the goals that their customer is trying to reach. It assists the financial advisor or banker to have a full picture of their customer and their Household circumstances when carrying out reviews or seeking to suggest an appropriate service.

To read more in our Financial Service Cloud Series: